Is Tesla really more valuable than Toyota?

Why do some companies borrow and others sell shares?

Tesla just grows and grows. Journalists are not made of stone; who could resist the obvious car analogy?:

- Tesla overtakes GM as most valuable U.S. automaker, short sellers burned, Reuters, October 2019

- Tesla overtakes Volkswagen as value hits $100bn, BBC, January 2020

- Tesla overtakes Toyota to become world’s most valuable carmaker, Financial Times, July 2020

That 2019-2020 period was not an temporary aberration. Tesla's share price has held stable and it is still more valuable than all of these car companies today. At least, by the measure that the journalists are using.

These articles are comparing the "market capitalisation", or "market cap" for short. "Market cap" is the total value of all the shares that the company has issued. Price per share multiplied by the number of shares:

market cap = share price * share count

Here are the market caps for these four carmakers as of today:

| Carmaker | Market cap ($bn) |

|---|---|

| General Motors | 45 |

| Tesla | 558 |

| Toyota | 329 |

| Volkswagen | 65 |

If you wanted to buy Toyota, $329bn is the price you'd have to pay to get all the shares and assume total control (worth it to get the Previa back into production). Market cap seems, on the face of it, like the right measure of "valuable".

The problem is that the market cap isn't the whole picture and consequently it is a bit of a "vanity metric".

The missing billions

When you are running a company there are two different ways to raise money:

- Sell shares

- Borrow money (ie: take a loan from a bank, issue bonds, etc)

Carmakers in fact traditionally prefer to borrow money rather than sell shares. Here are our four carmakers, but with their borrowings as well as the market cap:

| Carmaker | Market cap ($bn) | Borrowings ($bn) |

|---|---|---|

| General Motors | 45 | 122 |

| Tesla | 558 | 9 |

| Toyota | 329 | 200 |

| Volkswagen | 65 | 194 |

Nine billion is a lot, but Tesla is in fact slightly unusual in having very little debt relative to its market cap. General Motors clearly has a bit of a preference for borrowing - its borrowings are twice its market cap. (That is not necessarily an excessive level.)

If you paid $45bn and bought all the General Motors shares you would have total control over the business. But you wouldn't have total control over all the profit. Most of "your" profit would be going out the door to people who had lent GM money in the past. So you can think of market capital as the "control price". But it's not the real price to get all the proceeds of the business - ie: all the value.

The price to buy the business and gain all its economic value is the enterprise value. That is the market cap, plus the price of the debt minus the cash. Minus the cash? Companies routinely hold largish amounts of cash (or "cash equivalents") on hand and you just discount that from the price because you'd get that sum returned to you instantly if you bought it.

enterprise value = market cap + borrowings - cash

Here are the enterprise values of these companies (please scroll the table horizontally on mobile):

| Carmaker | Market cap ($bn) | Borrowings ($bn) | Cash ($bn) | Enterprise value ($bn) |

|---|---|---|---|---|

| General Motors | 45 | 122 | 26 | 142 |

| Tesla | 558 | 9 | 15 | 553 |

| Toyota | 329 | 200 | 62 | 466 |

| Volkswagen | 65 | 194 | 77 | 188 |

Yes, Tesla is more valuable than Toyota. But Toyota is much closer than it looks based on just market cap.

Why borrow money instead of selling shares? Or vice versa?

Imagine you're the chief exec of a carmaker - should you finance your new yottafactory via selling shares, or should your instead borrow money from the bond market?

As a competent chief exec you will be telling the public frequently and often that your company is well worth its share price, and then some. You will sing grand songs about the future, about chatbots, about self-driving cars, blockchains, generative AI, whatever. Anything to support the share price. Or better yet, increase it.

But your finance director (who is dour, and keeps tweeting about IFRS guidelines on revenue recognition) will have an internal model for what the company is really worth. If your market cap is much higher than his private valuation, he will advise you to issue shares instead of issuing bonds.

A high share price relative to your true value constitutes the defacto ability to finance cheaply.

Companies do tend to recognise when their shares are overpriced. They start doing funny things, like acquiring other companies in "all-share" transactions. Those are the kind where you buy someone, but pay with your own shares.

Singleton-minded

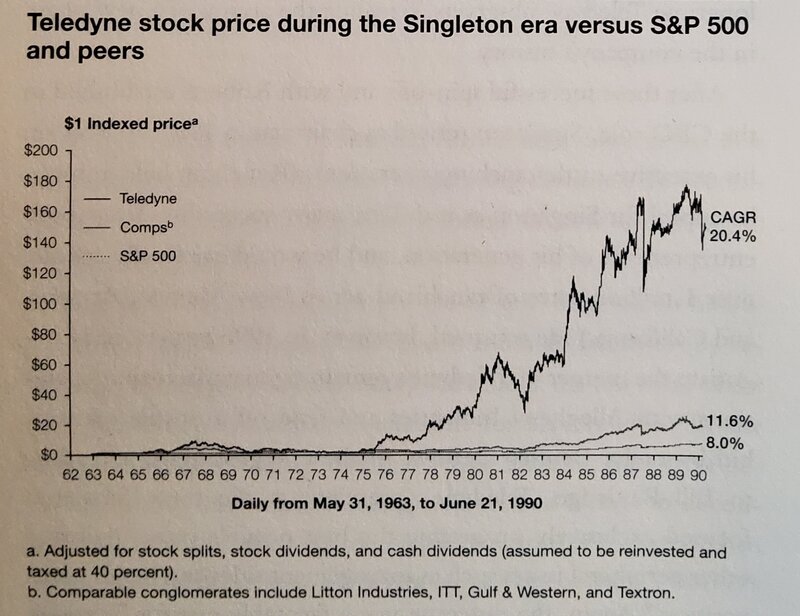

One of the companies most successful at optimising its own financing was Teledyne.

The 1960s were a time of huge hype for "conglomerates" - companies consisting of many different and unrelated subsidiaries. The theory at the time was that there were big synergies between these constituent businesses.

The classic 1960s example of synergy was between selling microwaves and also microwave dinners. The plan was to make a killing cross selling microwave dinners to the people you'd already sold microwaves to. Please understand: this made more sense at the time.

Due to this mania, the shares of conglomerates at the time were valued at very high multiples on their earnings. Their market caps would be 15 times their annual profit, or more. They would then use their overvalued shares to buy up ordinary, non-conglomerated, businesses whose market caps were based on lower multiples due to their acute lack of microwave synergies.

After completing each acquisition the newly embiggened conglomerate would then add the earnings of their new subsidiary to their own and enjoy their new, even higher market cap. Everyone is chuckling because now that business that was valued at 8 times earnings is now valued at 15. Value creation for shareholders - brill!

Teledyne bought a lot of stuff during this area, inhaling over a 100 other companies and bloating up itself substantially. At the highest point in the bubble period Teledyne's share price was $130.

The bubble popped around 1970. It had become clear to all that there was no specific reason for you to buy your dinner from the man who'd sold you your microwave.

Responding to its new, post-bubble, lower share price, in 1971 Teledyne disbanded its mergers and acquisitions team. Unable to pay with its own overvalued shares, it never bought anything again.

Instead, with its internal models showing that Teledyne's own stocks were now dramatically undervalued, it started to buy them back at the new, lower, price of $15 a share. In fact Teledyne even took out loans in order to fully capitalise on its own low share prices.

Teledyne continued its monster share buyback for another decade or so before finally spinning out many of the businesses it had bought and issuing a chonking great dividend in the late 1980s.

Teledyne's return over the period was phenomenal:

The founder of Teledyne, Henry Singleton, didn't do too badly out of it. He used his share of proceeds to buy a big ranch in New Mexico.

Wealthy billionaires nowadays don't like to retire to the country. They tend to use their built-up wealth and power to selflessly tackle humanity's hardest problems: eradicating malaria; reducing the costs of spaceflight; arresting climate change; improving state education or moderating Twitter.

Contact/etc

Other notes

Many of the great and the good have been caught out by Tesla's meteoric rise. David Einhorn is a respected financier. He is most famous, at least in my mind, for publicly announcing doubts about Lehman Brothers which hastened their collapse. He had a long-standing and public short position on Tesla which I think ran for multiple years and ended in a big loss. In 2018 an American clothing brand got some viral marketing by sending him a box of consolation shorts. Tesla's share price has gone up another 10 fold since then.

You can read more about Henry Singleton in the William Thorndike's book The Outsiders which has a cheesy subtitle but I assure you is very good. But it doesn't mention that he was also an early investor in Apple Computer.

The 1960s conglomerate that notoriously tried to combine microwaves with microwave food (and microwave cookbooks, microwavable dishes, etc) was Litton. Singleton actually worked there early in his career, probably having met Tex Thornton in the the second world war precursor to the CIA.

Classically there is a third way to raise money: retained profit. I have skipped over it because detailing would take me too far into accounting. I want to discuss balance sheet stuff, not income statement stuff.

I should disclose that some of my numbers on market cap and enterprise value are not very precise. For example, the financial years of these carmakers do not align and I have used annual numbers rather than quarterlies. Some of the carmakers have complicated ownership quirks which depress their share price, for example VW is effectively controlled by Porsche, a strange company in themselves. Toyota's main supplier of parts is an off-balance-sheet related-business. There are lots of other complications - but please do write if I've made a major mistake.

I impart here one of my darkest and most controversial views: the M&M theorem is utter, utter bollocks. If it is true at all, that can only be in such a narrow sense as to be completely irrelevant to real world corporate finance. Teledyne is just one contradiction.

I never liked Betteridge's law of headlines and confound it with pleasure.